Spain’s Non-Lucrative Visa: Complete Guide and How to Apply

Thinking about moving to Spain on a Non-Lucrative Visa in 2025? This visa lets you live in Spain without working. It’s ideal if you are retiring, taking a career break, or living off passive income. In this guide, you’ll find the process, requirements, costs, and what to expect once in Spain.

Key Takeaways

- The Non-Lucrative Visa (NLV) lets non-EU citizens live in Spain without working.

- You can include your spouse and children if you meet extra income rules.

- Income needed in 2025: about €2,400/month for you + €600/month per dependent.

- You must apply from outside Spain at a Spanish consulate.

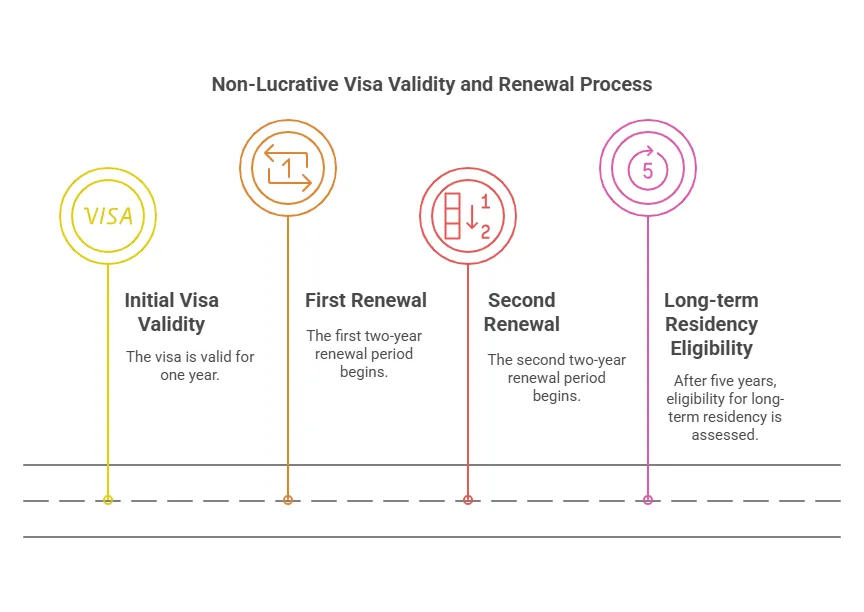

- The visa is valid for 1 year and renewable for 2 years at a time.

- Start renewal paperwork 60 days before your card expires.

Get your personalized relocation checklist, step-by-step guidance, and access to our complete immigration app.

What is the Spain Non-Lucrative Visa (NLV)?

The NLV lets non-EU citizens live in Spain without working. It’s popular with retirees and people living from savings or passive income. The visa is valid for 1 year, then renewable for 2 years at a time, leading to permanent residency after 5 years.

Who is Eligible for the Non-Lucrative Visa?

You're eligible for the NLV if you are:

-

Nationality: non-EEA (EU countries, plus Iceland, Liechtenstein and Norway), or Swiss national

-

Clean Record: Have no criminal record in the past 5 years

-

Financial and Health Requirement:

- Have sufficient financial means to support yourself (and family, if applicable)

- Covered by private health insurance in Spain

-

Other Conditions:

- Not living illegally in Spain

- Not planning to work in Spain

- Not subject to a re-entry ban or part of a voluntary return commitment

Financial Requirements for the NLV in Spain 2025

Minimum Income (2025)

You must show stable income or savings to support your stay:

- €2,400/month or €28,800/year for the main applicant (400 % of IPREM)

- +€600/month or €7,200/year for each family member (100 % of IPREM)

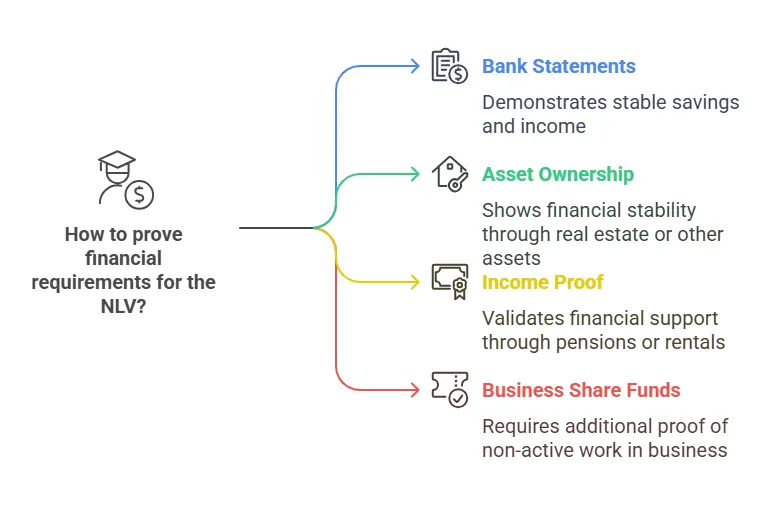

How to Prove Funds

- Recent bank statements, savings balances, or tax returns demonstrating consistent income

- Ownership of assets (e.g., real estate)

- Income from pensions, dividends, or rentals

Interactive Tool: Calculate your IPREM requirements for Spanish visas. Open IPREM / NLV Income Calculator in new tab

2026 IPREM / NLV Income Calculator

Estimate the minimum passive income you must show for the Spain non‑lucrative visa.

Household

Adds one dependent (100% IPREM).

Each child counts as one dependent. (0‑10)

Other dependents (optional)

Only if accepted (e.g. dependent parent). (0‑5)

IPREM Base

Main applicant: 400% IPREM + each dependent: 100%.

Results

Monthly

€2,400

Yearly

€28,800

Do I Need to Pay Taxes in Spain on a Non-Lucrative Visa?

If you live in Spain more than 183 days per year, you are a tax resident. That means:

- You must declare your worldwide income to Spanish tax authorities and file an annual tax return (declaración de la renta).

- Income from abroad (pensions, dividends, rental income, etc.) must be reported annually.

- Double-tax treaties may reduce double payments..

- You are not required to pay into Spanish Social Security unless you switch to a work/residence permit later.

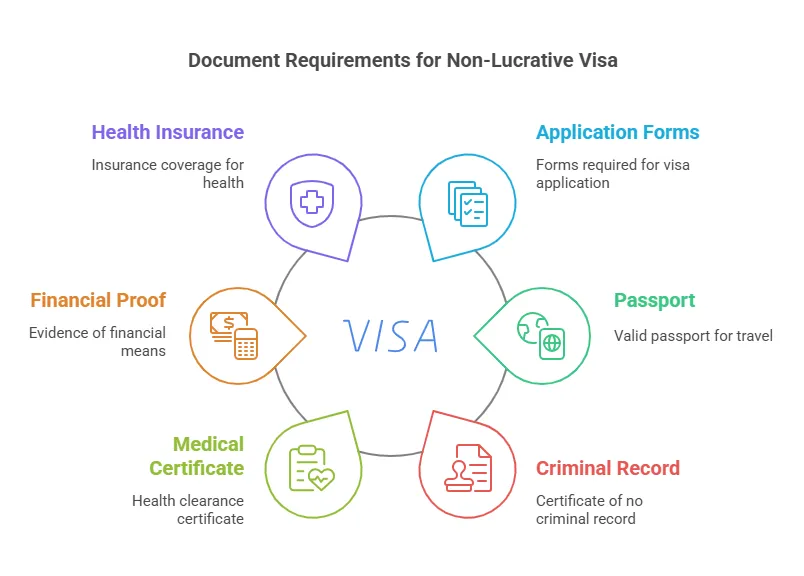

What Documents Are Required for the Non-Lucrative Visa?

Application Forms:

- Completed Non-Lucrative residence visa application form EX-01↗ (in duplicate)

- Visa Application Form↗

Personal Documents

- Passport valid for at least 1 year

- Criminal record certificate (issued in the last 90 days)

- Medical certificate confirming that you do not suffer from any disease that could have serious public health repercussions. The statement must read:'This medical certificate states that Mr./Ms. [Full Name] does not suffer from any disease that may have serious public health implications in accordance with the International Health Regulations of 2005.' It must be written on official letterhead and signed by a licensed doctor (include their registration number). Be dated within three months of the application.

- Passport-sized photos (usually 2)

Financial & Insurance Documents

- Proof of financial means (bank certificates, investment docs, etc.)

- Private health insurance valid in Spain, with no copay or deductibles from a Spanish-authorized insurer with at least 12 months of validity (travel insurance is not accepted).

Consular Requirement

- Proof of residence in the consular district.

Heading Important note about ownership of funds

Funds must be in the applicant’s own name. Third-party sponsorships (for example, a friend or relative’s bank account) are generally not accepted unless you are applying as a family unit and the principal applicant demonstrates sufficient means for all dependents.

Spain Non‑Lucrative Visa Timeline 2025

Use this step‑by‑step countdown to make sure no document or fee slips through the cracks:

| Weeks Out | Task | Resources |

|---|---|---|

| T‑12 | Order apostilled birth & marriage certificates (valid 6 mos) | — |

| T‑10 | Buy private health insurance that meets NLV rules | Compare insurers |

| T‑8 | Request FBI/ACRO police check with express shipping | Background‑check FAQ |

| T‑6 | Translate & legalise documents; budget €50‑€70 per page | Translator list |

| T‑4 | Book consulate appointment; prep EX‑01 forms in duplicate | <a href="#section-4" rel="nofollow">Doc list</a> |

| T‑2 | Pay Tasa 790 052 + visa fee; print receipts | Fee explainer |

| T‑1 | Attend appointment for biometrics | — |

| Decision (≈ 4‑8 wks) | Collect passport with visa; arrange flights | — |

| Entry Day 0‑90 | Land in Spain, apply for TIE card + empadronamiento | <a href="#section-7" rel="nofollow">TIE guide</a> |

✅ Pro‑tip: Set calendar reminders 60 days before your visa’s one‑year mark to start the renewal early.

How to Apply for the Spain Non-Lucrative Visa?

Step 1: Apply at Consulate

Apply for a Non-Lucrative Visa at the Spanish Consulate or Embassy in your country of residence (for applicants in the United States, choose the consulate covering your state, e.g., Los Angeles, New York, Miami).

Step 2: Pay the Fees:

Pay the application costs, including the visa fee (varies by country) and the residence-authorization fee Tasa 790 052↗ (tick box 2.1 "Autorización inicial de residencia temporal").

Step 3: Attend Appointment

Attend the visa appointment in person (or via a legal guardian) and submit your biometric data (fingerprints and photo).

Step 4: Wait for Decision

The decision can take up to 3 months.

Step 5: Collect Visa

Once approved, collect your visa within 1 month; the sticker in your passport carries a 90-day validity period for entry.

Once granted, you must enter Spain within that validity period and complete the steps below.

Common reasons for rejection

Checking these items carefully before submission can significantly improve your approval chances:

- Submitting health insurance with copayments or deductibles and insufficient coverage.

- Missing the International Health Regulations (2005) text in your medical certificate.

- Providing bank statements under a different name (not in the applicant's own name).

- Forgetting apostilles or sworn Spanish translations on key documents.

- Expired background checks (must be issued within 90 days).

- Lack of clear proof of accommodation in Spain.

What Happens After You Arrive in Spain?

Apply for Your TIE

- Apply for your Foreigner’s Identity Card (TIE) within 1 month of arrival; your biometric data (fingerprints) will be taken at this appointment.

- Book an appointment at your local Extranjería (immigration office)

What to Bring

- Your passport and visa

- Filled and signed EX-17 form↗ (application for the TIE)

- 1 passport-sized photo

- Proof of payment for Tasa 790 012↗ (select "TIE que documenta la primera concesión de la autorización de residencia temporal, de estancia o para trabajadores transfronterizos", around €16)

- Empadronamiento (residency certificate or housing proof from your Local Town Hall)

How Long Is the Non-Lucrative Visa Valid and Can It Be Renewed?

The NLV is initially valid for 1 year. It can then be renewed for:

- 2 years after the first year

- Another 2 years after that

After 5 years, you may qualify for long-term or permanent residency↗.

To renew, you must show:

- Continued financial means

- Valid private health insurance

- Proof of living in Spain at least 183 days per year

Can My Family Join Me Under the Non-Lucrative Visa?

Who Can Join

Yes, your spouse and dependent children can apply as dependents.

Requirements:

- Provide proof of family relationship (marriage/birth certificates)

- Show additional income for each member (€7,200/year per dependent)

- Include them in your application at the consulate

- Provide individual documents: passport, health insurance, criminal certificate (if over 18), medical certificate.

Can Children on a Non-Lucrative Visa Access Public Services?

Yes, children of NLV holders can access public healthcare and public education in Spain.

Education

Available from age 3 (infantil) to secondary school (registration is based on your address).

Healthcare

Accessible through Spain’s universal system.

Even though NLV holders don't contribute to Social Security, Spain still provides access for minors as a right. However, private insurance is required for all applicants as the primary coverage.

Spain non-lucrative visa to permanent residency

When You Can Apply

NLV holders can apply for permanent residency after 5 years.

Conditions

Continuous 5 years in Spain, no absences over 6 months per year (or 10 months total in 5 years), clean criminal record, valid renewals.

Are There Any Limitations to the Non-Lucrative Visa?

Work Restrictions

You cannot work or freelance in Spain (including remote work based in Spain) or operate commercially

Residency Obligation

You must reside in Spain at least 183 days per year

Card Renewal

You must renew your TIE card as required

How do you renew the Non-Lucrative Visa?

You can renew your Non-Lucrative Residence authorization starting 60 days before it expires or up to 90 days after the expiration date.

Renewals are processed either online via the Mercurio platform↗ or at your local Oficina de Extranjería through prior appointment↗.

You must demonstrate:

- Continuous residence in Spain (empadronamiento and copy of your passport pages with entry records)

- Ongoing financial means equal to or above the current IPREM multiple for your household.

- Active private health insurance with the same full coverage requirements.

- A clean criminal record.

The first renewal grants another two-year residence, and after five years you may apply for long-term residence (residencia de larga duración)."

Do documents need to be legalized or translated?

All foreign documents (criminal records, medical certificates, marriage or birth certificates) must be apostilled or legalized and translated into Spanish by a sworn translator (traductor jurado).

Ensure translations use the same currency and amounts shown in your originals, converting to euros when applicable using the Banco de España reference rate↗ on the date of issue."

Get your personalized relocation checklist, step-by-step guidance, and access to our complete immigration app.

Frequently Asked Questions

Gerard B.

An expat who's done it, so you don't have to!

After spending years in Spain and thousands of euros on lawyers, tax advisors, and residency applications, only to realize that doing it yourself is often easier, cheaper, and just as effective. Gerard is an expat on a mission to help others avoid the same costly mistakes. By creating LiveLoveSpain, Gerard aims to share first-hand experiences, practical tips, and plenty of "Why didn't anyone tell me this?!" moments. Whether it's filing taxes, understanding visas, or just mastering the art of the sobremesa, he's here to help fellow expats integrate seamlessly without breaking the bank.