Spain's Digital Nomad Visa (International Teleworker Visa) - A Complete Guide

Spain's Digital Nomad Visa (DNV), officially the International Teleworker Visa, lets non-EU citizens live in Spain while working remotely for foreign employers. To be eligible in 2025 the minimum income is €2 763 / month (200% of SMI), plus €1 036/month for a spouse and €345/month per dependent, the consular fee is ~€80 and the typical approval time is 15-45 days, making it one of Europe’s fastest remote-worker permits.

Key Takeaways

- Who Can Apply?: The Digital Nomad Visa (DNV) is available to remote employees working for non-Spanish companies and self-employed professionals with predominantly international clients. Spanish clients cannot make up more than 20% of business activity.

- General Requirements (2025): Applicants must prove at least €2 763 / month (200% SMI). Spouse requires +75% (€1 036/month), each dependent +25% (€345/month), private health cover, 3+ months with employer (or 3 years’ experience for freelancers), and a clean criminal record.

- Costs & Timeline: Consular visa fee €80–€100, NIE €12, TIE €16; average processing 30 days (range 15–45).

- Bringing Family: Spouses, unmarried partners, dependent relatives and dependent children can be included, with additional income requirements (75% of SMI for spouses, 25% for each dependent) and proof of legal kinship.

- Residency and Tax Benefits: The visa is initially valid for one year, extendable to three years, and renewable for up to five years. After five years, applicants can apply for permanent residency. Tax benefits include eligibility for the Beckham Law, offering a flat 24% income tax on earnings up to €600,000 for up to six years.

- Path to Citizenship: After ten years of legal residence, Digital Nomad Visa holders may apply for Spanish citizenship, requiring proof of cultural integration and Spanish language proficiency.

Get your personalized relocation checklist, step-by-step guidance, and access to our complete immigration app.

What is Spain's Digital Nomad Visa (DNV) or International Teleworker Visa?

Spain's Digital Nomad Visa (DNV), officially known as the "International Teleworker Visa," enables non-EU citizens to reside in Spain while working remotely for non-Spanish companies. This initiative aims to attract international talent, boost the local economy, and foster cultural exchange. Official Source↗.

Key Facts & Fast Answers (2025)

- Minimum income (2025): €2 763/month

- Governmentt fees: Visa €80 – €100 · NIE €12 · TIE €16

- Processing time: 15 – 45 days (avg 30)

- Family income add-ons: +75 % spouse · +25 % each child

- Tax perk: 24 % flat rate (Bekham Law) on income and no tax on foreign income (capped at €600 000)

Eligibility for the Digital Nomad Visa (2025)

To qualify, applicants must meet several criteria:

Who can apply?

- Non-EU nationals.

- Remote employees or self-employed freelancers working for companies outside Spain.

Work criteria

- Employees: must have a valid job contract with a foreign employer allowing remote work.

- Freelancers: must prove active clients abroad, with no more than 20% of revenue from Spanish companies.

Income rule (2025)

- Main applicant: €2 763/month (200% SMI).

- Spouse/partner: €1 036/month (75% SMI).

- Each dependent: €345/month (25% SMI).

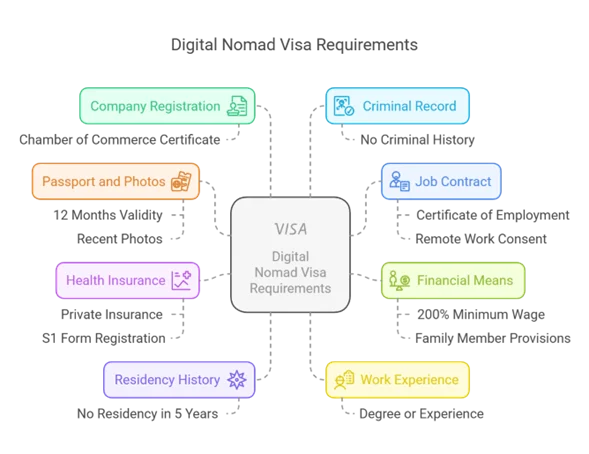

What are the general requirements for Remote Employees to apply for the Digital Nomad Visa (DNV)?

Identity

- Passport with at least 12 months of validity

- 2 recent passport-sized photos.

Residence history

Have not lived in Spain for the last 5 years.

Work experience

Holding an undergraduate or postgraduate degree or have at least 3 years of work experience in current field of activity.

Employment proof

Submit a certificate proving that they have been working with the company for at least 3 months prior to applying to the Digital Nomad Visa. A certificate showing the length of the contract, salary, and providing explicit consent that the employee works remotely from Spain.

Company Registration

A certificate issued by the country's Chamber of Commerce, certifying the type of business and date of creation of the company, which should be at least 1 year before the application.

Financial Means

The applicant's income must be at least 200% of the monthly Spanish national minimum wage (€2 763 i.e. 200 % of 2025 SMI). In the case of moving with family members: For the first family member: an additional 75% (€1 036).For each additional applicant: 25% (€345).

Health insurance

Original and copy of the certificate accrediting a private health insurance contracted that is authorized to operate in Spain or proof of being registered in the Spanish National Social Security through the S1 form↗.

Clean Criminal Record

Present a certificate showing no criminal history in the past five years.

What are the general requirements for Self-Employed Professionals to apply for the Digital Nomad Visa (DNV)?

Identity

- Passport with at least 12 months of validity

- 2 recent passport-sized photos.

Residence history

Have not lived in Spain for the last 5 years.

Work experience

Holding an undergraduate or postgraduate degree or have at least 3 years of work experience in current field of activity.

Financial Means

The applicant's income must be at least 200% of the monthly Spanish national minimum wage (€2 763 i.e. 200 % of 2025 SMI). In the case of moving with family members: For the first family member: an additional 75% (€1 036 per month). For each additional applicant: 25% (€345 per month).

Proof of contracts with client(s) including length and terms

Company Registration (if applicable)

Certificate issued by the country's Chamber of Commerce, certifying the type of business and date of creation of the company, which should be at least 1 year before the application.

Health insurance

Original and copy of the certificate accrediting a private health insurance contracted that is authorized to operate in Spain or proof of being registered in the Spanish National Social Security through the S1 form↗.

Clean Criminal Record

Present a certificate showing no criminal history in the past five years.

Interactive Tool: Check if you meet Spain's SMI requirements. Open Spain SMI / Digital Nomad Visa Calculator in new tab

Spain SMI / Digital Nomad Visa Calculator

Estimate the minimum monthly income you must show for the Spain Digital Nomad Visa (SMI-based).

Household

Adds spouse at 75% SMI.

Each child: 25% SMI (0‑10)

Each: 25% SMI (0‑5)

Results

Monthly

€2,764

Yearly

€33,168

Can I move with my family under the Digital Nomad Visa (DNV)?

Who can join

- The spouse or unmarried partner.

- Dependent children and dependent relatives in the ascending line who form part of the family unit.

Documentation Proving Kinship

- For Spouse or Unregistered Partners: Marriage certificate or certificate of registration as an unmarried couple.

- For Children: A birth certificate, adoption certificate, or family book (for adult children, a document proving financial dependence and civil status).

- Dependent Relatives: Documents proving they are in the applicant's dependent care, including for example monthly transfers and other receipts.

The documents must be legalized or apostilled and submitted together with an official Spanish translation.

Proof of financial means

- For Spouse or Unmarried Partner: 75% of the SMI (€1 036 per month).

- For each additional dependent: 25% of the SMI (€345 per month). Proof of funds must cover each dependent per month and be demonstrated via bank statements or regular income.

Where to apply for the Digital Nomad Visa (DNV)?

Applying from outside Spain (visa route)

- Submit your DNV visa application at the Spanish consulate in your country of residence

- After approval and entry, apply for your TIE card in Spain

Applying while in Spain (residence route)

- If you are already in Spain and meet the criteria, you may apply directly for the residence permit for international teleworkers at your local Extranjería (immigration office)

- You will still need a NIE and the full set of supporting documents.

Do I need to apply for a Foreign Identity Number (NIE) prior to the Digital Nomad Visa (DNV) application?

Yes, prior to applying for the Digital Nomad Visa (DNV), the applicant must have a valid Foreign Identity Number (NIE), more information on how to obtain a NIE in Spain in 2025.

- If the applicant is already in Spain, they may request a NIE from the Extranjeria (Immigration office).

- If the applicant will be applying from abroad, they can request the NIE from the Spanish Consulate or Embassy.

How can I apply for the Foreign Identity Number (NIE) needed for my Digital Nomad Visa (DNV)?

To get more detailed information, check out our article How to Obtain a NIE in Spain in 2025 (Foreigner Identification Number)↗. If applying from your country's Spanish consulate or embassy:

- Fill form EX-15↗, select "NIE" in section 4.1 and "Oficina Consular" in section 4.3.

- Provide the original and a copy of the passport. If the applicant is a minor or incapacitated, a copy of the family record book, birth certificate, or guardianship document must be presented. Additionally, the valid passport or ID of the parent or guardian must be shown.

- Submit proof of residence in the country where you are applying.

- Fill out Tax form 790-012↗.

The embassy or consulate may request documents pertaining to the Digital Nomad Visa requirements, so ensure you have those available.

The documents must be legalized or apostilled and submitted with an official Spanish translation.

Applicants must present both originals and copies of the above documents, along with proof of tax payment, at the embassy or consulate.

Note: A NIE obtained via the consular office identifies the bearer to all levels of the Spanish public administration but does not entitle the holder to reside in Spain or prove residence there.

The processing time is generally around 3 weeks, with the NIE sent to the email address provided in form EX-15.

If already in Spain, complete steps 1 and 4, schedule an appointment (Cita) at the local immigration office (Extranjeria), and submit the required documentation.

Digital Nomad Visa vs Non-Lucrative Visa (Quick Comparison)

| Feature | Digital Nomad Visa (DNV) | Non-Lucrative Visa (NLV) |

|---|---|---|

| Can work for a foreign company | ✅ | ❌ |

| Minimum income | €2 763/mo | €2 400/mo |

| Tax regime | 24 % flat (Beckham) | Progressive |

| Path to Long-Term Residency/Citizenship | 5 yrs / 10 yrs | 5 yrs / 10 yrs |

Glossary of Spanish Immigration Acronyms

- NIE: Número de Identidad de Extranjero

- TIE: Tarjeta de Identidad de Extranjero

- SMI: Salario Mínimo Interprofesional

- INSS: Spanish Social Security

Common Pitfalls & Troubleshooting

- Salary proof below €2 763 → attach last 6 payslips + employer letter.

- Documents not apostilled → submit Hague Apostille.

- Health insurance lacks Spain coverage → policy must show nationwide.

- >20 % Spanish client income (freelancers) → supply invoicing breakdown.

- Criminal-record certificate older than 90 days → renew before appointment.

Costs & Processing Timeline

| Step | Government fee | Typical days |

|---|---|---|

| Consular visa | €80 - €100 | 15 - 30 |

| NIE number | €12 | 3 |

| TIE card | €16 | 40 |

Totals: €108 - €128 · Expect total €108–€128 in fees. Average timeline: 30 days

How to apply for a Digital Nomad Visa (DNV)?

To apply to the Digital Nomad Visa (DNV) in your country of residence:

- Fill the Visa application for each applicant. For minors, the visa application must be signed by one of their parents: Visa Application Form↗.

- Gather all the required documents:

- Passport valid for at least 1 year.

- 2 passport-sized color photos.

- A recent Criminal Record Certificate (not older than 3 months) issued by the countries of residence for the past 2 years.

- The applicant's CV showing work and years of experience.

- The applicant's University Degree or Professional certificate.

- Bank statement with receipts and payslips.

- Health insurance certificate with coverage in Spain or Spanish public social security registration certificate (Régimen de Trabajadores Autónomos de la Seguridad Social Española).

- Proof of residence in the country where you are applying.

- Visa fee payment receipt (in some cases, this is paid at the consular section directly).

For Employees

- Employment letter from the company showing that the applicant has been employed for at least 3 months, certifying the salary and type of contract.

- An official letter from the company providing explicit consent for remote work from Spain and a declaration to comply with Spanish social security obligations.

For Self-Employed

- Documentation with contract length, terms, and conditions for working in Spain, and a declaration to comply with Spanish social security obligations.

- Company registration certificate issued by your country's Chamber of Commerce (if applicable).

Refer to your country's Spanish consulate or embassy for any specific requirements that may apply.

- Schedule a visa appointment at the Spanish embassy or consulate.

- Pay the visa fee (typically €80 but may vary depending on your country's currency) before your appointment.

- Attend the visa appointment with all original documents, copies, and 2 passport-sized photos.

The visa process takes between 15 and 45 days. You will be notified when your visa is ready for collection.

This visa is valid for up to 1 year or for the same duration as the authorization to live and work in Spain.

If you plan to stay in Spain for more than a year, you should apply for a Residence Permit Card (TIE). If not, obtaining a Residence Permit Card is not mandatory.

I have a Digital Nomad Visa (DNV), how do I apply for the Residence Permit Card (TIE)?

If you are already in Spain, make sure to apply for a NIE using Form EX-15 and Tax form 790-012 as detailed above.

Once you are in Spain on the Digital Nomad Visa, to apply for the residence permit card, which is valid for 3 years and renewable up to 5 years (after which you can apply for Permanent Residency), follow these steps:

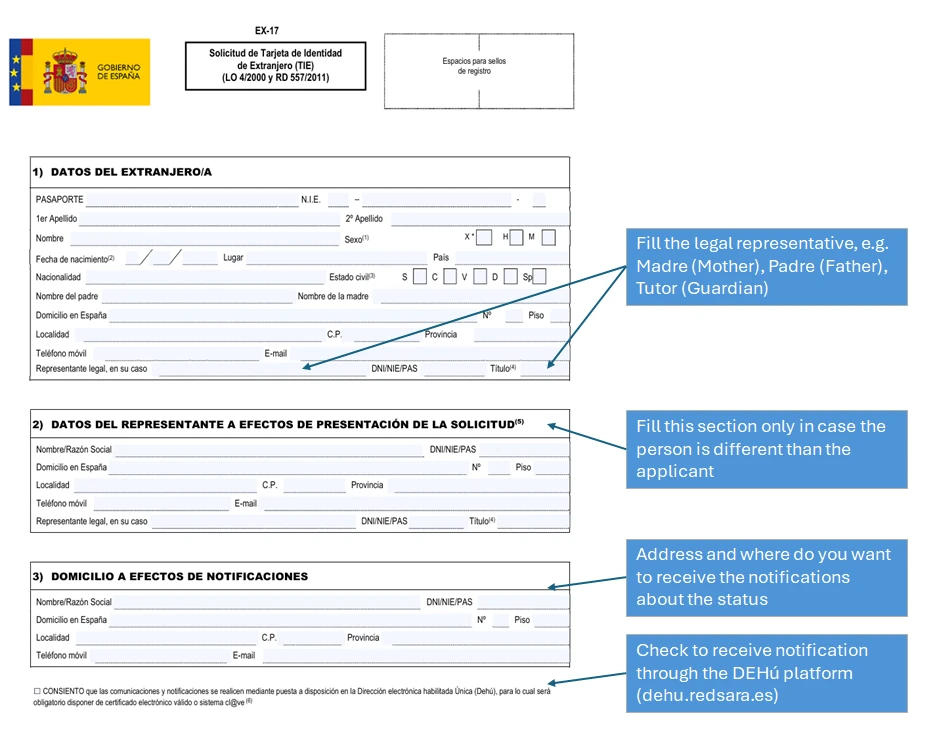

- Fill Form EX-17↗, selecting "TARJETA INICIAL" in section 4.1.

- Pay Tasa 790 012, selecting the applicable option under "Tarjetas de identidad de extranjeros (TIE) y certificados de registro de residentes comunitarios."

- Get an appointment at the Extranjeria↗ or your local Police Station↗.

Attend the appointment with a recent photo and provide biometric data.

It takes approximately 40 days for the TIE card to be ready for collection.

How do I fill the Form EX-17 to apply for the Residence Permit Card (TIE)?

To Fill Form EX-17↗, follow these steps:

How to pay for Tax 790 012?

You can pay for Tax 790 012 by filling the tax form and payingonline or at your nearest bank, follow these steps:

How to Check if Your TIE Card is Ready for Collection

It usually takes about 30-40 days for your TIE (Tarjeta de Identidad de Extranjero) card to be ready, but here's how you can check precisely if your card is available:

-

Locate Your Lot Number:

- Find the receipt you received when submitting your TIE application. Your lot number (número de lote) is indicated here.

-

Visit the Official Website:

- Go to the Cita previa de Extranjería website↗.

-

Select Your Province and Office:

- Choose your province from the list provided.

- Under "Selecciona Oficina", choose the specific office where you submitted your TIE application.

-

Select the Relevant Procedure:

- In "Selecciona trámite", choose "RECOGIDA DE TARJETA DE IDENTIDAD DE EXTRANJERO (TIE)", then click "ACCEPTAR".

-

Check the Latest Lot Number:

- The next page will display the message "EL ÚLTIMO LOTE RECIBIDO EN LA OFICINA SELECCIONADA ES EL [NUMERO]".

If your lot number is less than or equal to the displayed lot number, your TIE card is ready for collection. If your lot number is higher, you must wait and check again later.

Once confirmed, proceed to book your appointment for collection.

What are the Tax rules for Digital Nomads in Spain?

Holders of Spain's Digital Nomad Visa (DNV) can benefit from the Special Expat Regime, commonly known as the "Beckham Law.". Tax benefit: Eligible for Spain’s Beckham Law – 24% flat rate up to €600 000/year for 6 years.

Interactive Tool: Calculate your potential tax savings with Beckham Law. Open Spain Beckham Law Tax Calculator in new tab

Beckham Law Tax CalculatorCompare your estimated Spanish income tax with and without the Beckham Law (24% flat expat regime).

Quickly estimate your Spanish income tax and net income under both the Beckham Law and the standard regime. All calculations are approximate and for guidance only.

Digital Nomad Visa (DNV) to Permanent Residency

The Digital Nomad Visa (DNV) is initially valid for one year. The residency is then issued for 3 years and can be renewed for up to five years. After five years of continuous legal residence in Spain, permit holders may apply for permanent residency.

Digital Nomad Visa (DNV) to Citizenship

After ten years of legal residence in Spain, holders of the Digital Nomad Visa (DNV) may be eligible to apply for Spanish citizenship. Applicants must demonstrate sufficient integration, including knowledge of the Spanish language and culture, and renounce their previous citizenship, unless their country of origin has a dual nationality agreement with Spain.

Get your personalized relocation checklist, step-by-step guidance, and access to our complete immigration app.

Frequently Asked Questions

Gerard B.

An expat who's done it, so you don't have to!

After spending years in Spain and thousands of euros on lawyers, tax advisors, and residency applications, only to realize that doing it yourself is often easier, cheaper, and just as effective. Gerard is an expat on a mission to help others avoid the same costly mistakes. By creating LiveLoveSpain, Gerard aims to share first-hand experiences, practical tips, and plenty of "Why didn't anyone tell me this?!" moments. Whether it's filing taxes, understanding visas, or just mastering the art of the sobremesa, he's here to help fellow expats integrate seamlessly without breaking the bank.