Renting vs Buying in Spain: The Ultimate Guide for Expats (2025)

Spain is one of the most sought-after destinations for expats, retirees, and digital nomads looking for a great quality of life. But when it comes to housing, should you rent or buy? This guide breaks down the key factors: costs, legal requirements, and pros and cons to help you make the right decision.

Key Takeaways

- Buying a newly constructed home requires almost as much attention to detail as buying a previously owned one.

- Tenants have strong rights in Spain, including protected lease terms and eviction restrictions.

- Inspect a new home carefully, as it can have hidden defects.

- When viewing model homes, understand what's standard and what constitutes an upgraded feature, which of course will cost you more.

- You should have your own real estate agent and research your own mortgage, don't assume the builder's terms are the best.

- It is inadvisable to turn down a home inspection, even if it costs you money.

Get your personalized relocation checklist, step-by-step guidance, and access to our complete immigration app.

1. The Housing Market in Spain: An Overview

Spain’s real estate market has seen significant changes over the past decade. While property prices have steadily increased in major cities like Madrid, Barcelona, and Valencia, they remain lower than in other European capitals. Rental prices have also surged, especially in high-demand areas, making the decision to rent or buy even more crucial.

2. Renting vs. Buying in Spain: A Decision Matrix

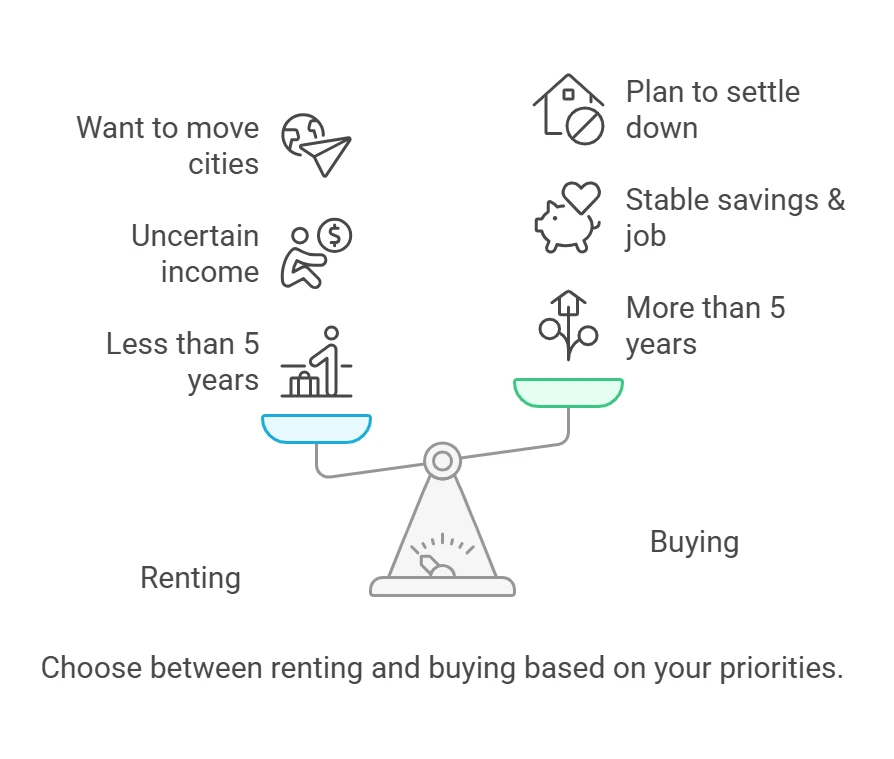

To help expats make the best decision, use the following decision matrix based on personal and financial factors:

| Factor | Renting is Better If… | Buying is Better If… |

|---|---|---|

| Length of Stay | Less than 5 years | More than 5 years |

| Financial Stability | Uncertain income | Stable savings & job |

| Flexibility | Want to move cities | Plan to settle down |

| Investment Purpose | No investment intent | Want to build equity |

| Risk and Repairs | Repairs and expenses are handled by landlord | Owner would handle all repairs and expenses |

| Predictability and Investing | Landload may decide to raise rent or even sell the property | As a homeowner you can leverage increase in the home value or loss due to depreciation |

3. Tax Implications: Renting vs. Buying in Spain

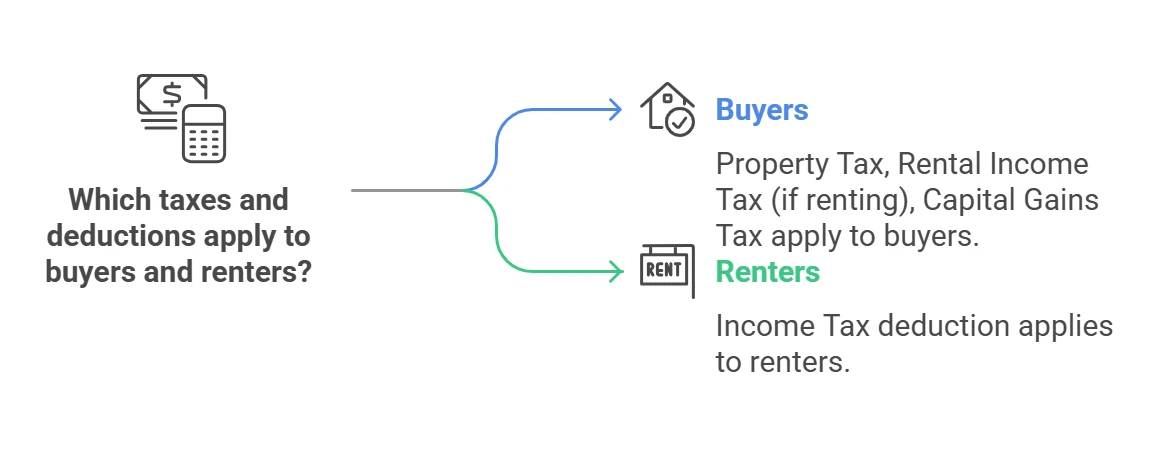

Many expats overlook the tax impact of their housing choice. Here’s a quick comparison:

| Tax Type | Applies to Buyers | Applies to Renters |

|---|---|---|

| Property Tax (IBI) | ✅ Yes | ❌ No |

| Rental Income Tax | ✅ Yes, if renting out | ❌ No |

| Capital Gains Tax | ✅ Yes, if selling | ❌ No |

| Income Tax Deduction | ❌ No | ✅ Possible deduction |

4. Legal Considerations & Tenant Rights in Spain

Spain has strong tenant protection laws, primarily governed by the Ley de Arrendamientos Urbanos (LAU) or Urban Leases Law (Law 29/1994, last updated in Royal Decree-Law 7/2019)↗. These laws regulate long-term rentals, landlord obligations, tenant rights, and eviction procedures.

Tenant Rights:

- Lease Duration & Renewal (Article 9 & 10, LAU 29/1994): Leases are typically 1–5 years, depending on the type of contract. If the landlord is an individual, the minimum lease duration is 5 years (7 years if the landlord is a legal entity). If a contract is signed for a shorter period, it is automatically extended up to 5 years unless the tenant decides to leave. After 5 years, contracts renew yearly for up to 3 additional years, unless either party gives 4 months’ notice (landlord) or 2 months’ notice (tenant).Leases are typically 1–5 years.

- Tenants are Not Liable for Normal Wear and Tear – Under Article 21 of the Urban Leases Law (LAU, 29/1994), tenants are not responsible for repairs due to normal use or aging of the property. Landlords must cover maintenance for structural issues, plumbing, and essential utilities.

- Eviction Rules – Landlords Cannot Evict Without Legal Cause (Article 27, LAU 29/1994): Eviction without cause is illegal in Spain. A landlord can only evict tenants for: Non-payment of rent or utilities, Subletting without permission, Severe property damage, Personal use (if the owner needs the property for themselves or immediate family – must be stated in the contract). Notice period for eviction: If the tenant has paid rent on time, landlords must give at least 2 months’ notice before requesting the property back.

- Security Deposit Rules (Article 36, LAU 29/1994): Landlords must return the security deposit within 30 days after the tenant moves out. The deposit is equal to one month’s rent for residential leases and two months’ rent for commercial leases. If damages occur, landlords must provide itemized proof before withholding any amount.

About Rent Increases and Limits in Spain:

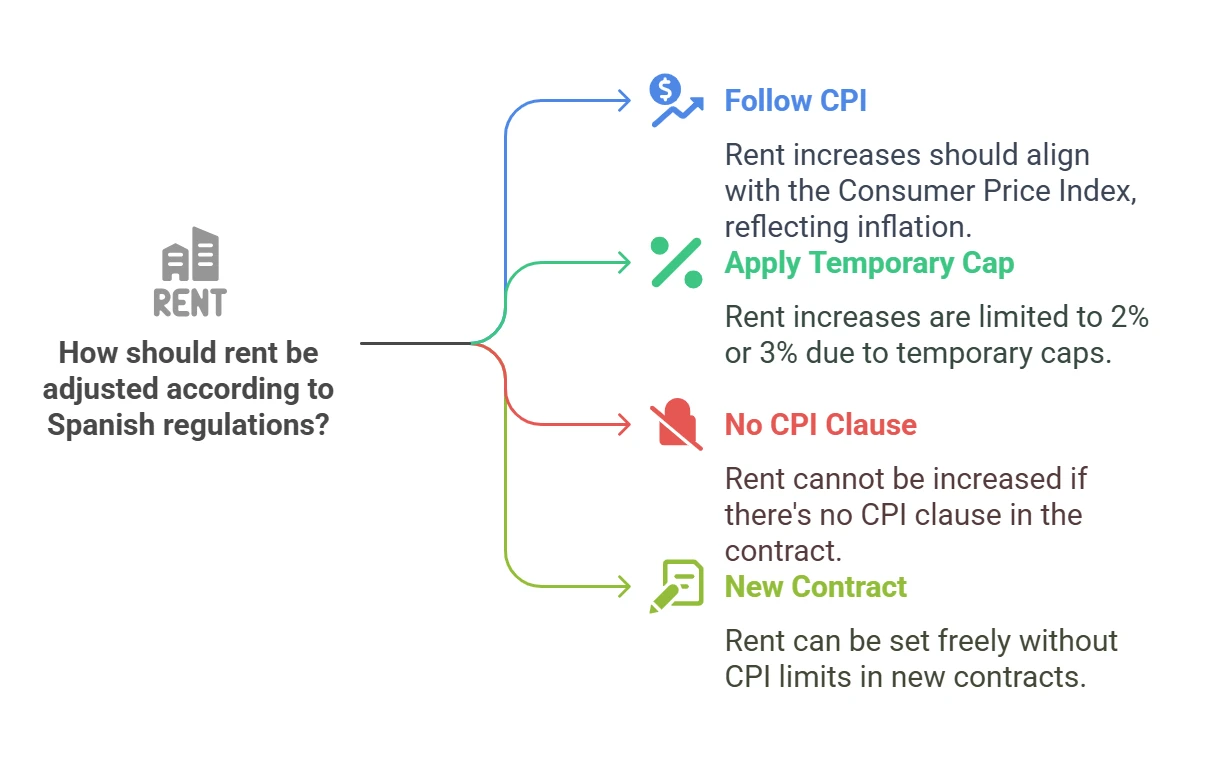

- Standard Rule: Rent Increases Are Tied to CPI. Under Article 18 of the Urban Leases Law (LAU), rent increases for long-term leases must follow CPI unless stated otherwise in the contract. The CPI is published monthly↗ by Spain’s National Statistics Institute (INE) and reflects inflation.

- Temporary Rent Caps (2023–2024): Due to inflation, Spain capped rent increases at 2% (2023) and 3% (2024), overriding CPI. This applies mainly to large landlords (10+ properties), while small landlords can still adjust rent based on CPI.

- Exceptions & New Contracts: If a lease lacks a CPI clause, rent cannot be increased during the contract. New rental contracts are not subject to CPI limits, allowing landlords to set a new price. Short-term and tourist rentals (less than 1 year) are exempt from rent regulations.

- Rent Controls in High-Demand Areas (Ley 12/2023): In regulated zones, large landlords cannot increase rent beyond set limits.

Mortgage Application Process: Step-by-Step Guide for Expats in Spain

Applying for a mortgage as an expat in Spain involves several straightforward steps:

- Step 1: Determine Your Budget & Pre-qualification – Evaluate finances and get pre-qualified to know your maximum loan amount.

- Step 2: Find Your Ideal Property – Search reputable property platforms like Idealista, Fotocasa, and Habitaclia.

- Step 3: Gather Essential Documents – Prepare your NIE, passport, proof of income, credit reports, and employment details.

- Step 4: Compare Mortgage Options – Check interest rates from multiple banks (typically 3–5% for expats in 2025).

- Step 5: Arrange Property Valuation – Obtain an independent bank-approved valuation (tasación), costing around €300–€600.

- Step 6: Submit the Final Application – Provide the selected bank with all documentation, including NIE, income verification, credit reports, and valuation results. Expect 2–4 weeks for final approval.

- Step 7: Finalize the Purchase – Sign the purchase contract at the notary, pay taxes and fees (10–15% of the property price), and complete the property registration.

5. Cost of Living Comparison: Renting vs. Buying in Spanish Cities

Housing costs vary widely across Spain, for more information on overall cost of living, you can check out our Cost Explorer↗.

| City | Avg. Rent (1-Bedroom in Center) | Avg. Property Price per m² |

|---|---|---|

| Madrid | €1,300–€1,800/month | €5,000–€7,000/m² |

| Barcelona | €1,300–€1,700/month | €4,500–€6,500/m² |

| Valencia | €800–€1,200/month | €2,500–€3,500/m² |

| Seville | €700–€1,000/month | €2,000–€3,200/m² |

6. Can You Get Residency in Spain by Buying Property? (Golden Visa & Other Residency Options)

Buying property can help secure Spanish residency in some cases:

- Golden Visa (option no longer available as of 2025): Requires a €500,000+ investment. Grants residency & Schengen access with no requirement to live in Spain full-time.

- Non-Lucrative Visa: Buying property may help demonstrate financial stability.

- Digital Nomad Visa: No property purchase requirement, but having a long-term lease or property ownership can strengthen your application.

7. Hidden Costs & Unexpected Expenses of Buying a Property

Beyond the purchase price, homeowners must consider:

- Mortgage setup fees (~1–2% of property value).

- Property tax (IBI).

- Homeowners Association (Comunidad) fees.

- Maintenance costs (repairs, renovations, etc.).

8. How to Avoid Rental & Property Scams

Here are key warning signs and how to protect yourself:

- Too-Good-To-Be-True Prices – If the rent or property price is significantly lower than the market average, it may be a scam.

- Upfront Payment Requests Without Viewing and reviewing the contract – Never pay a deposit or transfer money before physically visiting the property.

- Fake Listings & Identity Theft – Fraudsters often copy real listings and change contact details. Verify ownership and that a copy of the owner's ID is provided before signing any agreements.

- Unclear or Nonexistent Rental Contracts – Legitimate rentals require a signed contract following Spain's rental laws. Avoid verbal agreements.

- Pressure Tactics & Urgency – Scammers may rush you into making quick decisions to secure a 'limited-time deal.' Take your time to verify everything.

- Unregistered or Unlicensed Agents – Always work with registered real estate agents (API-certified) and verify their credentials.

- Ownership Verification – Request a Nota Simple from the Land Registry (Registro de la Propiedad) to confirm the owner and legal status of the property before purchasing.

- Fake Deposit & Payment Methods – Use secure payment methods and never send money via Western Union, cryptocurrency, or untraceable transfers.

Get your personalized relocation checklist, step-by-step guidance, and access to our complete immigration app.

Frequently Asked Questions

Gerard B.

An expat who's done it, so you don't have to!

After spending years in Spain and thousands of euros on lawyers, tax advisors, and residency applications, only to realize that doing it yourself is often easier, cheaper, and just as effective. Gerard is an expat on a mission to help others avoid the same costly mistakes. By creating LiveLoveSpain, Gerard aims to share first-hand experiences, practical tips, and plenty of "Why didn't anyone tell me this?!" moments. Whether it's filing taxes, understanding visas, or just mastering the art of the sobremesa, he's here to help fellow expats integrate seamlessly without breaking the bank.